Why work with Capital Mills?

A credit line to solve temporary liquidity squeezes might seem an ‘off the shelve’ product you can get at your local bank, but our specialization gives us an edge.

Is a credit line the right fit

for your business?

A credit line has specific use cases. To ensure a credit line is the right fit, your business should meet the following criteria:

We assess each application individually and can tailor solutions to your company’s unique needs. If you meet most of these criteria and are ready to scale, our team is happy to discuss your options and guide you through a fast, transparent process.

A typical challenge: seasonality in the leisure industry

Challenge

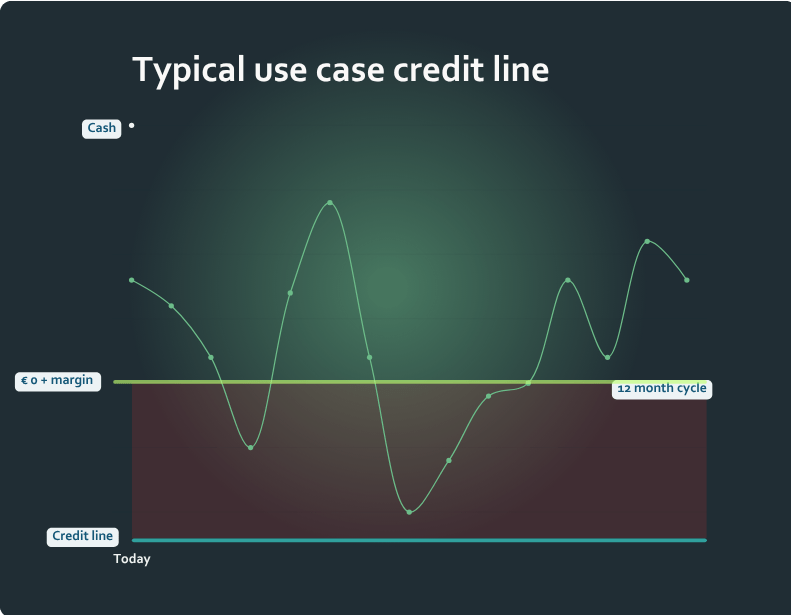

In the leisure industry, pay‑per‑use services ebb and flow with the revenues generated by service providers’ customers.

Solution

A credit line allows compensating weeks of slow cash inflows.

Results

A credit line can be more efficient than increasing working capital.

Impact

Next to an availability fee, interest is paid on the credit used.